Latest News:

2021-09-27

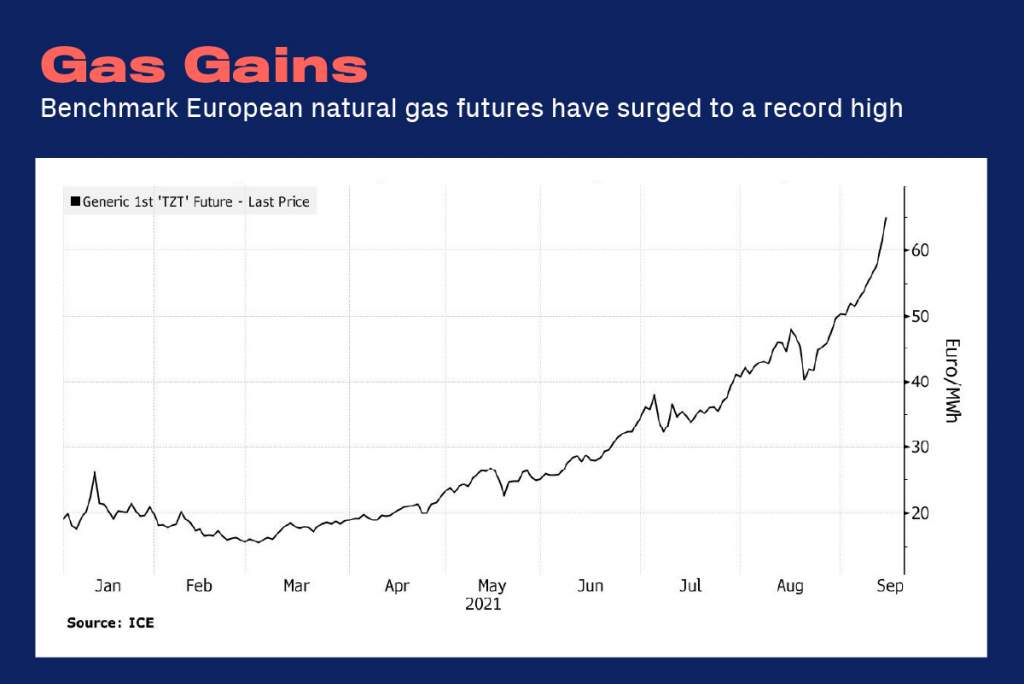

Europe´s unexpected severe weather conditions and the economic upturn from the Covid-19 pandemics strongly influenced global gas demand, affecting the natural gas prices in 2021. Likewise in the U.S., Natural Gas Prices per MWh have already hit record-high levels in the latest weeks. Costs for industries, as well as for the consumer´s bills, will likely keep growing in the upcoming months.

An unusually cold winter in Europe as well as a global economic rebound from Covid-19 have triggered strong global gas demand in 2021.

In Europe, unusually cold winter weather during the first quarter in 2021 with increased gas demand led to depleted gas storages. In addition, large parts of Europe experienced an unusually warm summer leading to higher summer gas demand for electricity. As consequence, Europe needed to secure additional gas volumes during the summer mainly from the U.S. because non-U.S. LNG availability was reduced by maintenance-related issues

Under ‘normal’ circumstances, these storages would have been filled in the summer period when demand is low and prices favorable. However, during this year’s gas buying season East Asian customers paid premium prices that directed LNG cargoes to the Far East markets. Europe’s natural-gas prices typically track lower than those seen in Asia, but now they have had to rise to attract flexible LNG cargoes in competition with Asian LNG.

Russia, on the other hand, has not stepped in to fill the gap this time. This may be partly due to price management and/or as a strategy to push forward the need for the U.S. opposed North Stream 2 connection to Germany, and Gazprom says it could pump 5.6 billion cubic meters of gas via Nord Stream 2 this year (which would still be too little to make up the current shortfall if the winter is cold). However, the primary reason for the absence of increased, and thereby more than contracted, gas volumes from Russia to Europe may very likely be a lack of capacity to produce significant extra volumes after a period of low investments in gas fields during the stretch of low prices in recent years. If so, the gas that would flow through Nord Stream 2 this year may be diverted from other pipelines rather than representing additional fuel.

Norway exports to the EU at a plateau and Norwegian gas production may soon enter a phase of sustained declining production.

Gas production from the Netherlands has collapsed by 72% since 2013 and will decline further with the final closure of the Groningen field in 2023.

Russia already now has two pipeline customers for its overall gas production with the 38 bcm per year capacity Power of Siberia pipeline. Gazprom has also begun design work on a second 50 Bcm/year gas pipeline Power of Siberia-2 that will carry Russian gas from the Yamal peninsula via Mongolia to China. This pipeline would give two potential customers for the gas in the main center of future gas production in Russia, the Yamal region of Russia. These new pipelines will give Russia a better negotiating position for contract price setting for the European market. Altogether, Gazprom has talked about the export of pipeline gas to China in the foreseeable future in the amount of over 130 Bcm/year.

U.S. gas prices have risen since the market has fallen behind on stocking up natural gas for winter use. Natural gas in U.S. underground storage is about 7% below the five-year average and only slightly above what it was in 2018 when natural gas inventories were at a record low heading into the winter.

U.S. consumption has so far not been the driving force for increasing U.S. natural gas prices since overall domestic natural gas consumption has been at normal levels. However, normally, excess natural gas during the summer that isn’t exported as LNG would go into underground storage. That domestic stockpiling has been reduced this year as the U.S. has exported roughly 10% of its natural gas production or 41% more than a year earlier. U.S. exports are also set to rise next year, from 14 bcf per year this year to 19 bcf per year in 2022, including pipeline and LNG exports.

In addition, Hurricane Ida has recently caused a considerable reduction in U.S. gas production, with about 50% of oil and gas production still offline in the Gulf of Mexico, and the hurricane season is still ongoing. To catch up U.S. natural gas producers would need to inject about 40% more than the five-year average gas into storage and the current pace of storage injection is still way below what is required to build enough stockpiles for the winter.

A higher gas to storage injection rate would require a rapid ramp-up from producers, which so far hasn’t materialized, even though natural gas prices have been climbing for three to four months. On the contrary, following almost a decade of production increases at the expense of overall negative profitability, natural gas producers have signaled that they will conserve cash and maintain relatively flat output in order to maximize shareholder returns on equity. Oil drillers, which produce associated gas, and natural-gas producers have indeed gradually increased their rig count, but the number of active rigs for both remains about 45% and 35%, respectively, below 2019 levels

Coinciding, Asia still needs to buy more gas than usual to reach acceptable storage levels while natural gas in storage in Europe is at a record low for September. As result, the global supply and demand balance later this year will depend on some fluctuating variables, including how severe winter will be in Europe, the U.S., China, and Russia, and at which time periods those cold snaps will occur.

A severe winter in the U.S. will mean that domestic markets must compete with Asian and European gas buyers, and If European and Asian natural gas prices stay at their current levels Henry Hub prices would have to jump to $10 or more to provide an incentive to meet domestic natural-gas demand. As a result, result gas supply for this winter season will be tight (Henry Hub futures curve have swung into backwardation) and U.S. prices are at risk of reaching the highs of 2008 when the U.S. was producing about 40% less natural gas.

U.S. GAS PRICE UPSIDE DRIVERS GOING FORWARD