Latest News:

2023-04-11

Brent crude oil prices have recovered since a USD 71/barrel low on the 20th of March surpassing 85 USD/barrel by the 4th of April following the 2nd of April OPEC+ alliance surprise announcement of a production cut of 1.1 million barrels per day. As consequence, Fundamental oil supply and demand factors are now more likely to get into the limelight again. Main reasons for a view of a further strengthening oil price are the announced OPEC production cuts, calmer financial markets with no major negative bank events, a growing optimism on oil demand from China’s reopening and an overall tight oil supply environment, with low non-OPEC (i.e. U.S. fracking) supply growth. The production outlook from U.S. oil production from fracking, more commonly called oil shale production, will be analysed in more detail in the following text.

The main oil event lately, beside the announced OPEC+ production cut, is the significant downward reductions in US shale oil output in the EIA March 2023 drilling productivity report (DPR). (EIA, 2023), as highlighted by Steven Kopits at Princeton Policy Advisors (Kopits, 2023). In the March DPR compared with the February DPR, shale oil output from the key plays was reduced by 447 000 barrels per day (bpd) for December and 250000 bpd for January. In the March DPR compared with the January DPR, shale oil production has been reduced by 549 000 bpd for December 2022. This is a significant revision, almost the equivalent of 5% of total US crude oil production in 2022 over a two-month period. (EIA, 2023).

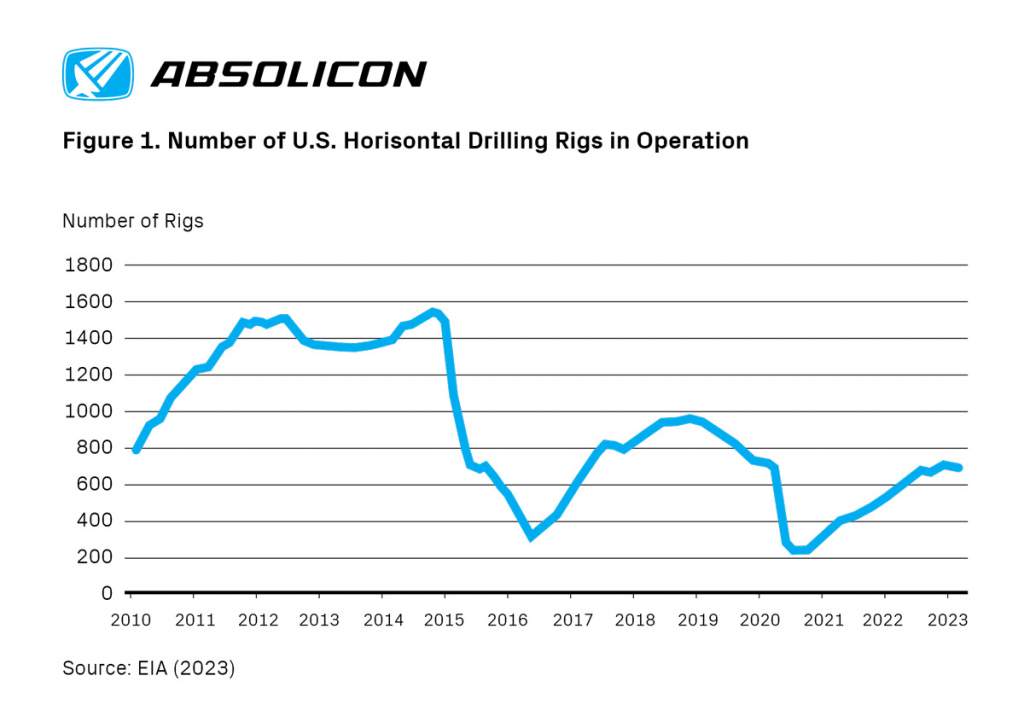

With this revision, US shale oil production is largely flat over the period September 2022 to January 2023, and there may also be downward revisions for the February, March and April production data in the April DPR report. The observed trends in shale oil supply are consistent with the overall US crude oil supply and the visible peak of horizontal oil drilling rigs (rigs fused for shale oil and gas), see Fig. 1., is now beginning to result in plateauing oil production.

Hence, a probable conclusion from the recent DPR is that US crude and condensate production growth may stagnate for the remainder of the year. This conclusion is reinforced by statements from oil industry executives declaring the U.S. shale boom over, cautioning against expectations of much higher production, warning that cost inflation is making a many wells uneconomical. In addition, many new wells have not been as productive as expected, a sign that the top drilling inventory of the U.S. shale industry is being exhausted.

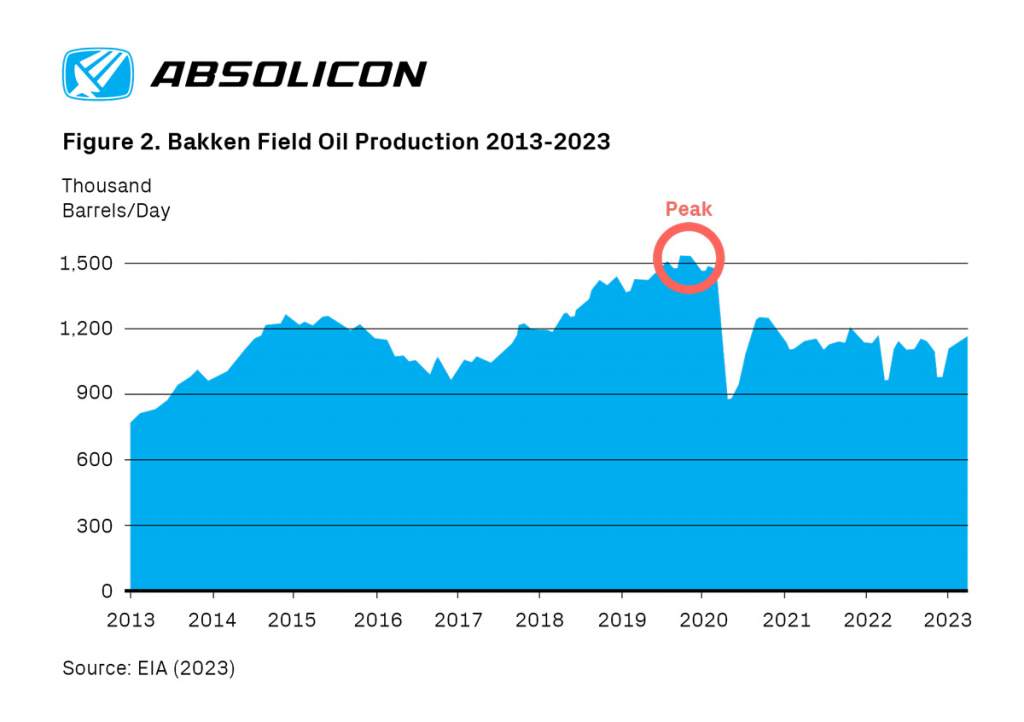

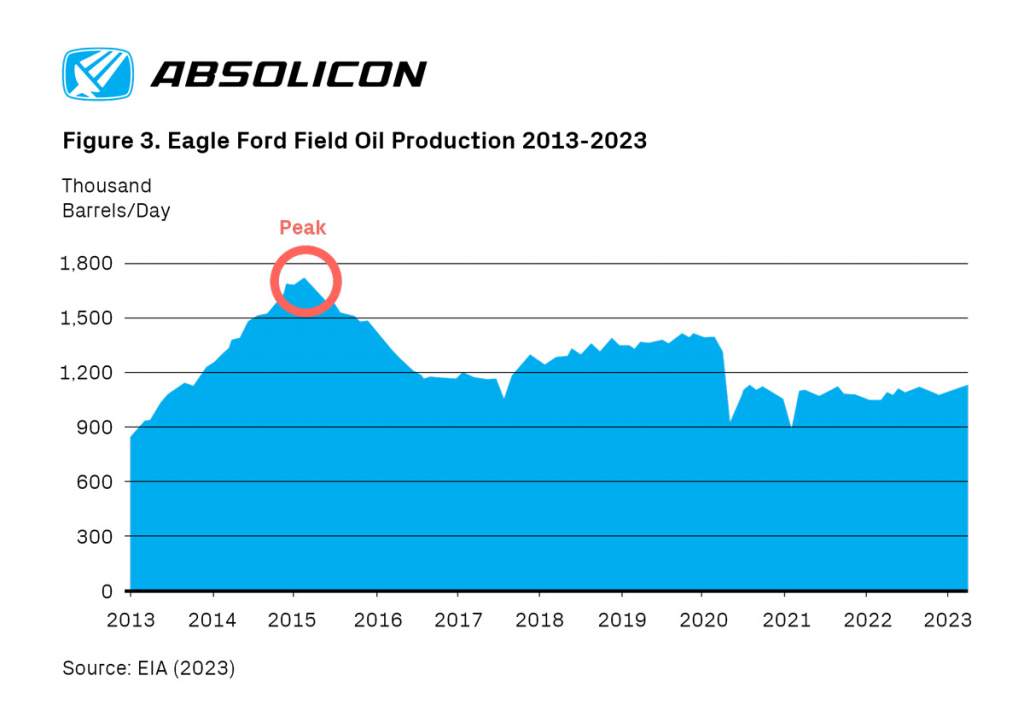

Below are the production figures for the three largest shale fields in the U.S included. As of March 2023, these three fields accounted for about 86% of U.S. shale oil production. Neither Bakken nor the Eagle Ford has been able to grow in recent years. Since January 2020, combined production from both fields have declined by 22%, despite a combined overall flat drilling activity in the two fields. The explanation lies is new well productivity, which has fallen by about 35% since making their highs in early 2021. Hence, the Eagle and Bakken fields are being depleted and they have run out of their top producing areas.

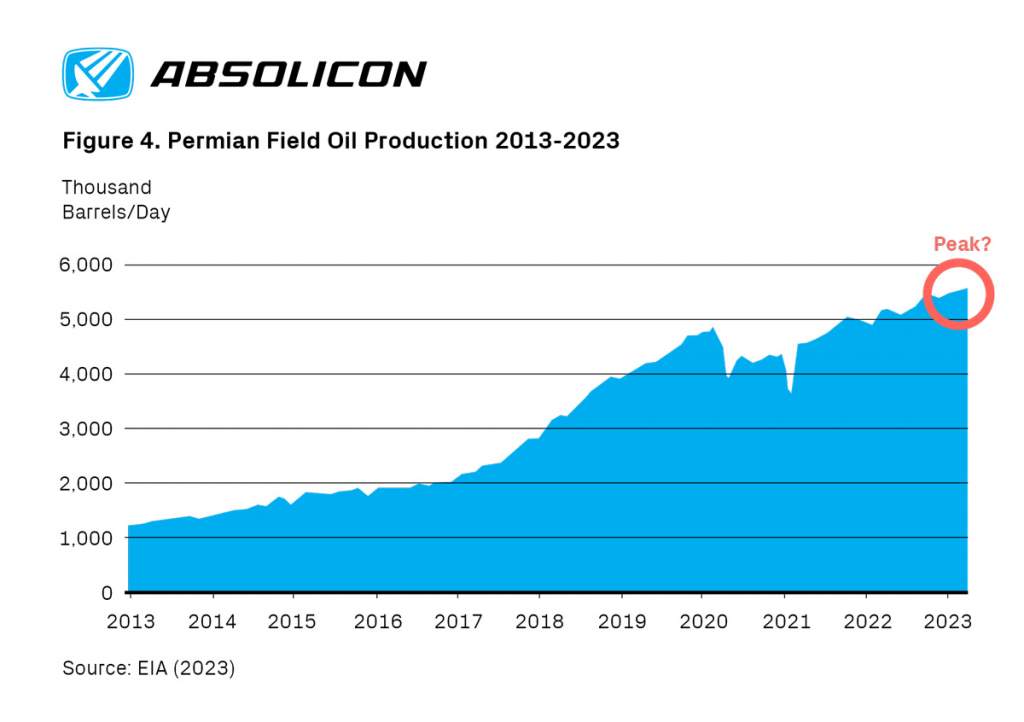

The Permian has been the oil only shale field to grow production since 2019. However, the Permian will follow the same development path as the Bakken and Eagle Ford, which means Permian production will peak, plateau, and start to decline. Plateauing production in the Permian may indeed start in a relative near future. The investment firm Goehring & Rosencwajg estimates the Permian will peak in 2024-2025 (Goehring & Rozencwajg, 2023). The oil and gas industry analyst firm Energy Aspects cautions that total U.S. crude oil output from shale basins could peak in 2024. (Bloomberg, 2023)

Once the Permian production decline begin, non-OPEC supply growth of oil may be difficult, perhaps impossible, to achieve, resulting in OPEC+ regaining total power of oil pricing, which previously in history, and very likely yet again, will lead to surging oil prices. Recall that no growth in non-OPEC supply during the 2003-2008 period allowed crude oil prices to advance by a factor 4 in 5 years.

Bloomberg, 2022. 22-10-14. “Shale Output at Risk of Peaking in 2024, Energy Aspects Says”.

EIA, 2023. EIA Drilling Productivity Report. 2023-03-13. https://www.eia.gov/petroleum/drilling/

Goehring & Rozencwajg, 2023. 2023-02-28. “The end of abundant energy: Shale production and Hubbert’s peak”.

Kopits, Steven. 2023-03-15. “Rigs, Spreads, and March DPR: Huge Shale Oil Supply Revisions ”. www.princetonpolicy.com/ppa-blog/2023/3/15/hi6novds423jhaiom6nq6hhy7rzl8m.

Bengt Söderbergh is an Energy Analyst & District Heating key account at Absolicon, with 20 years’ experience of analyzing energy markets. He has a MSc and a PhD in engineering and a MSc in Business and Economics. His PhD thesis was on Russian and Norwegian natural gas production and its implications for European energy security, as well as on global oil and natural gas production. Bengt has worked as a senior oil and gas market analyst at Fortum, Finland’s largest energy company, as a senior financial studies consultant at Ramboll Oil and Gas, Copenhagen, and as a market analyst at Stockholm Exergi, Sweden’s biggest district heating company. Bengt has also worked as an independent consultant providing expert business advice on global energy and raw material issues for commercial and public entities.