Latest News:

2023-04-24

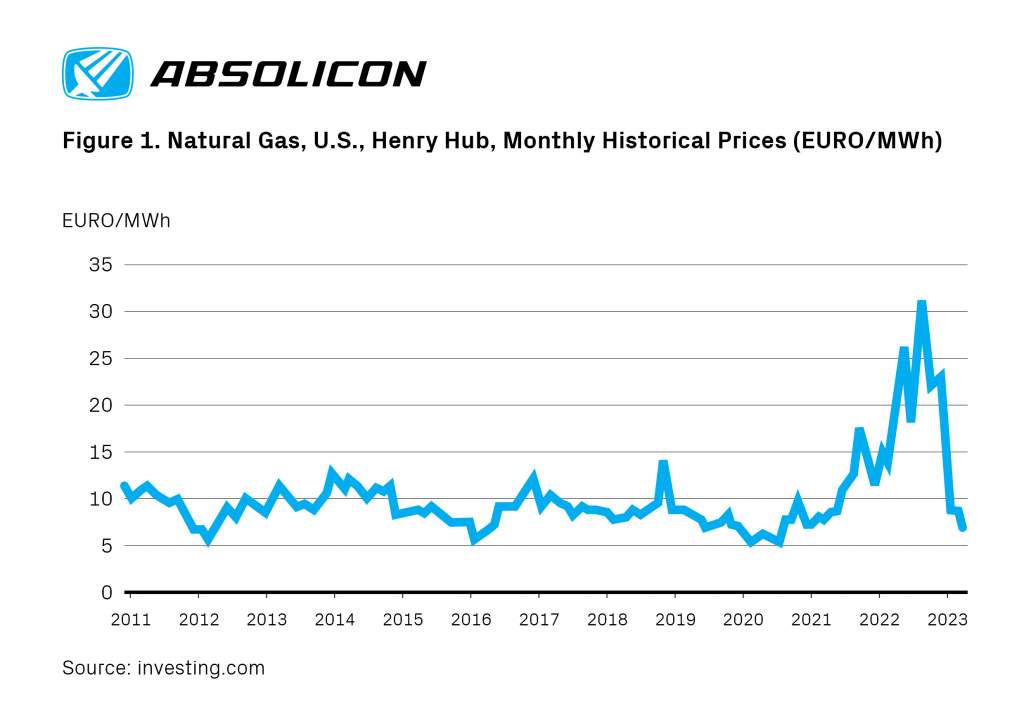

Henry Hub natural gas prices have decreased by almost 80% from the August 2022 highs at over 9 USD/mmcf (31 EURO/MWh), almost reaching 2 USD/mmcf (7 EURO/MWh) in March 2023, see Fig. 1.

However, the case for a coming convergence of U.S. gas prices towards international gas price levels, which currently are about six times higher, remain intact. – Why?

The primary reasons for the significant plunge in U.S. natural gas prices were the very mild winter weather (especially in the Northeast U.S) and in Europe, combined with the U.S. Freeport LNG liquefaction plant outage. The Freeport facility exported 2 bcf/day (equiv. to 21 bcm/year), until a fire on June 7th, 2022, closed it for 8 months. This outage reinforced the weather influenced demand reduction, tilting the U.S. supply demand balances to a supply surplus with growing gas storages as consequence.

However, The Freeport outage can explain almost all the natural gas inventory increase the latest 9 months. Now Freeport is up running again, and already a warmer North American summer could lead to a significant tighter U.S. natural gas market.

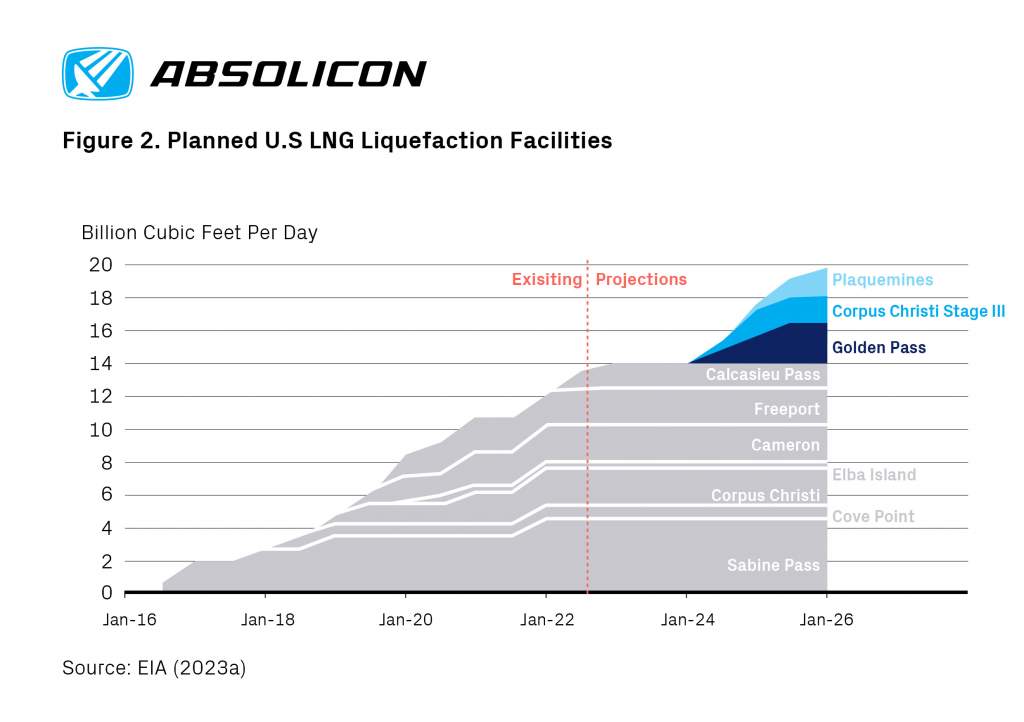

Looking forward, already in the 2024-25 period, 3 new LNG facilities are coming online.

In total, this equals another potential 5.5 bcf/day (57 bcm/year) of U.S. export natural gas demand the next year and a half. See Fig. 2.

However, looking at LNG projects beyond 2025, a final investment decision (FID) is taken for the Port Arthur Phase 1 Project (Texas), with start-year in 2027, adding 1.7 bcf/day (18 bcm/year), to be followed by a Phase 2 with 1.8 bcf/day (19 bcm/year).

In addition, projects yet to receive an FID are the following:

Rio Grande LNG 2.1 bcf/day (22bcm/year),

Rio Grande LNG Future Phases 1.4 bcf/day (15bcm/year)

Lake Charles LNG 2,2 bcf/day (22bcm/year)

In total, this equals another potential 9,3 bcf/day (96 bcm/year) of export demand this decade. As consequence, for 2024 and onwards, U.S. FID and non-FID LNG projects so far equals about 17% of total U.S. gas consumption, corresponding to the total natural gas use in California and New York combined. (EIA, 2023b). In addition, even more planned projects could be added on top of these in the coming years.

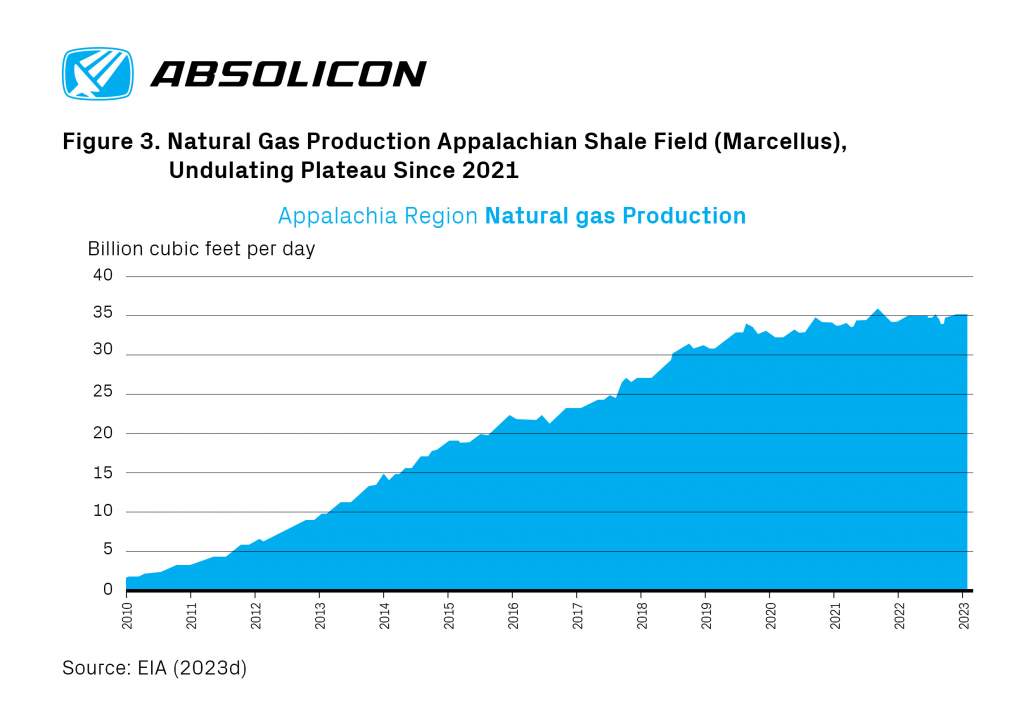

A large U.S: export of LNG would not lift U.S. natural gas prices higher if it would be matched with a higher domestic natural gas production. However, U.S. natural gas production is dominated by gas from the shale gas play, which equals about 80% of U.S. natural gas production, and the biggest fields are the shale gas fields.

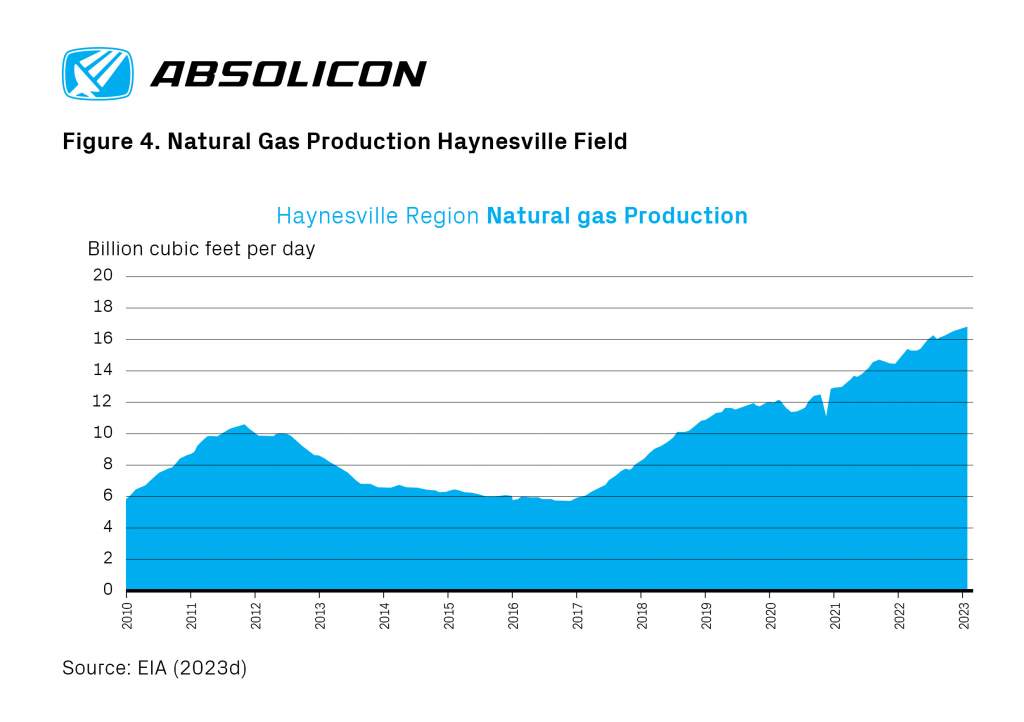

Never has U.S gas production been so concentrated, just three shale gas fields, The Appalachian, Haynesville and the Permian, constitute 60% of U.S. gas production. Two of the three largest gas fields in the U.S. are at or near their peak production.

The Appalachian shale field has been on a plateau for a year and a half. The Appalachian Region field accounts for about 29% of U.S. gas supply. (EIA, 2023c) See Fig. 3.

The Haynesville shale field accounts for about 14% of U.S. production, See Fig. 4. (EIA, 2023c). According to the investment firm Goehring & Rozencwajg, the Haynesville field may plateau within two years. (Goehring & Rozencwajg, 2023)

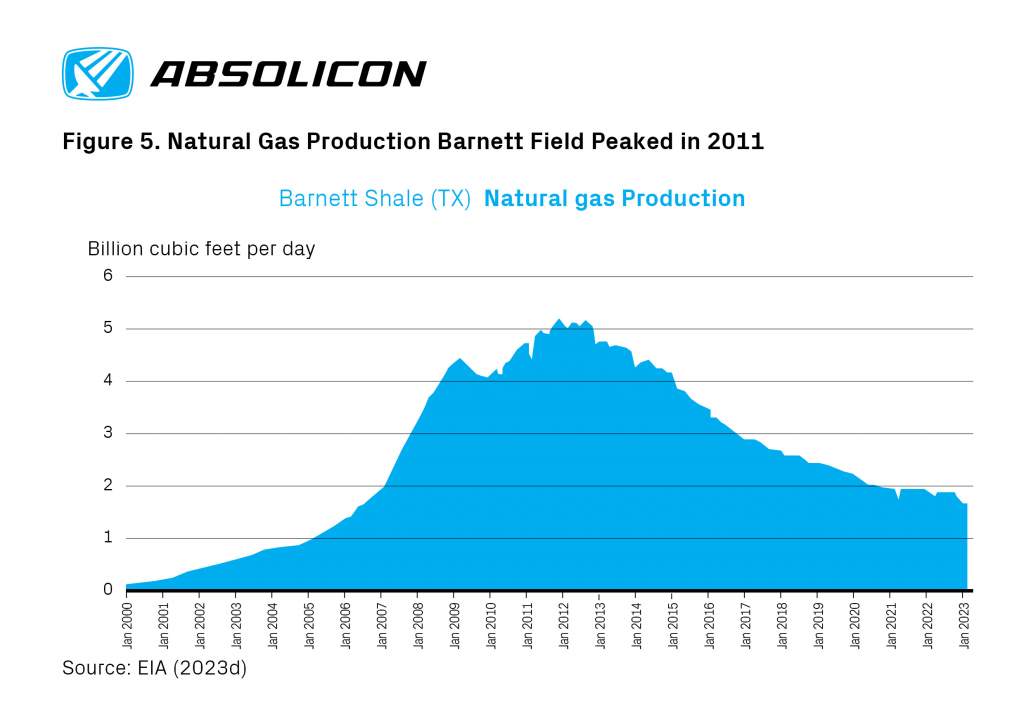

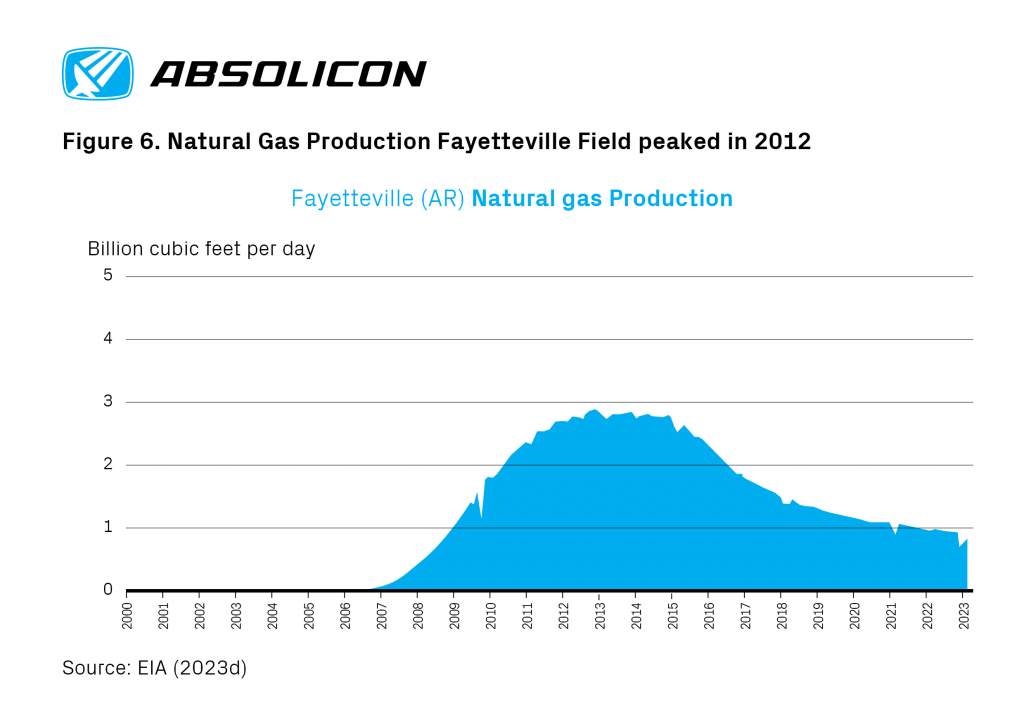

The Appalachian and the Haynesville have been the major sources for U.S. gas supply increase over the last decade. Eventually both fields will follow the pattern for the two first major shale gas fields that were put on production, the Barnett field and the Fayetteville field. Both fields peaked in the early 2010s and are both now 60% below their peak production. See Fig. 5 and Fig. 6.

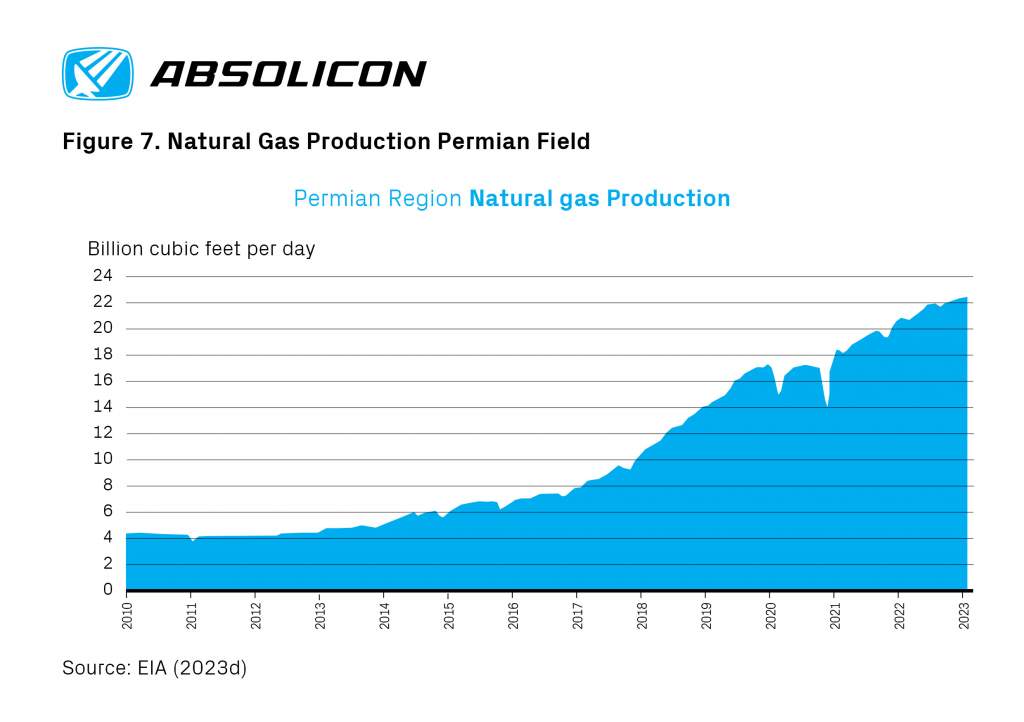

The remaining third largest gas field is the Permian field, which primarily is an oil field. The gas is associated with the oil production. When an oil field gets depleted, the pressure drops and the gas to oil ratio increases. Thus, the Permian gas production will remain a source of gas supply increase for some time. The Permian gas production represents about 18% of U.S. gas production. According to Goehring & Rozencwajg, Permian oil production is nearing its plateau phase and may peak in 2024-2025. (Goehring & Rozencwajg, 2023) A peak in Permian gas production will eventually follow the peak in Permian oil production. See Fig. 7.

To sum up:

Increased U.S. LNG export capacity, plateauing shale gas production and stable domestic U.S. natural gas demand, will lift U.S. gas prices from the very low levels where they are today. The key question that remains is more about timing. Will a very warm 2023 summer followed by a normal or cold winter trigger a rebound in U.S. natural gas prices? Or will it be the increasing U.S. LNG exports that by 2024-25 will finally tilt the balances, in favor of higher for longer U.S. prices, at price parity with international natural gas prices?

BP, 2022. “BP Statistical Review 2022”. www.bp.com.

EIA, 2023a. “U.S. LNG export capacity to grow as three additional projects begin construction” 2022-09-06. https://www.eia.gov/todayinenergy/detail.php?id=53719

EIA, 2023b. “U.S. natural gas consumption set nine monthly records and an annual record in 2022” 2023-03-14. https://www.eia.gov/todayinenergy/detail.php?id=55800

EIA, 2023c. EIA, “Today in” Energy. 2023-03-29 https://www.eia.gov/todayinenergy/detail.php?id=56000

EIA, 2023d. “EIA Drilling Productivity Report”. 2023-04-18. https://www.eia.gov/petroleum/drilling/

Goehring, Leigh, R., Rozencwajg, Adam, A.. 2023-02-28. “The end of abundant energy: Shale Production and Hubbert’s peak”. www.gorozen.com

Bengt Söderbergh is an Energy Analyst & District Heating key account at Absolicon, with 20 years’ experience of analyzing energy markets. He has a MSc and a PhD in engineering and a MSc in Business and Economics. His PhD thesis was on Russian and Norwegian natural gas production and its implications for European energy security, as well as on global oil and natural gas production. Bengt has worked as a senior oil and gas market analyst at Fortum, Finland’s largest energy company, as a senior financial studies consultant at Ramboll Oil and Gas, Copenhagen, and as a market analyst at Stockholm Exergi, Sweden’s biggest district heating company. Bengt has also worked as an independent consultant providing expert business advice on global energy and raw material issues for commercial and public entities.

Bengt’s Energy Blog: The end of the U.S, shale oil revolution >>